Oil demand has been decimated by Covid-19, bottoming in April at 76 million barrels per day, down 25% from 102 million barrels per day in December 2019. As economies reopen and mobility increases, the shape of oil demand recovery remains uncertain. In many ways, the coronavirus pandemic has accentuated the challenges and transformation that the oil and gas industry was undergoing, which has allowed the industry to respond much faster.

Most oil and gas companies dusted off their 2014 playbook and have pulled fairly traditional levers from past commodity cycles for short-term survival, such as managing liquidity, reducing costs and scaling back operations. But this downturn is unlike past cycles because the price pressure will remain due to a longer-term trend toward decarbonization.

As companies move from survival mode to longer-term reinvention, a new playbook will be needed. Oil and gas executives need to take stock of the competencies that will define success post-energy transition, figure out the gaps and fill them. There is no one-size-fits-all approach, and the industry will not respond in unison. Companies will go down different paths and the strategies that succeed will shape the future of the industry. The reshaping of the industry will occur over three phases: now, next and beyond.

Now: protect the business

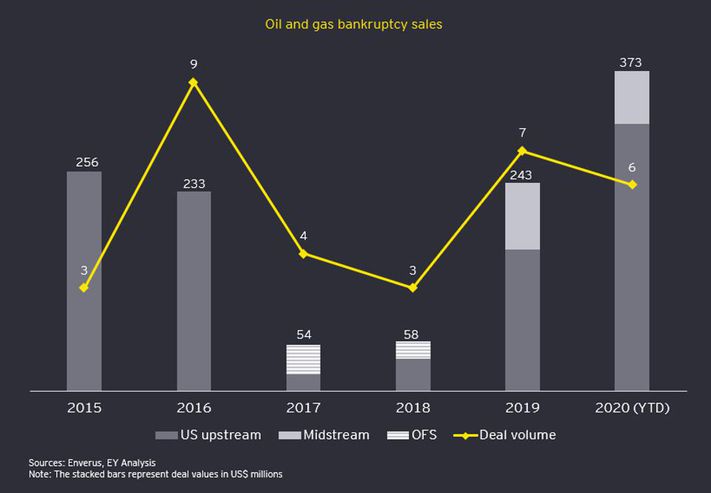

The “now” phase is the immediate response to the crisis, and companies are either at or near the end of that phase. Oil and gas companies have had to simultaneously adjust to the operational challenges of doing essential business and the financial challenges of reduced revenue and cash flow. The market has stabilized as demand has gradually rebounded and producers have curtailed output, but there have been, and will be, casualties. Oil and gas oversupply and depressed prices have spurred bankruptcies and impairments, primarily in the U.S. upstream sector. More than 20 oil and gas companies in the US have already filed for bankruptcy in 2020.

It may be tempting to dismiss this new wave of bankruptcies as just another chapter from the oil and gas playbook, but this round feels different. While there will be the predictable restructuring and shuffling of owners and management teams, many may simply cease to operate. Depressed prices and lack of access to capital for North America upstream and oilfield services companies will motivate more bankruptcies, asset sales and consolidation. Buyers will be looking carefully at the commodity markets, and a reduction in volatility could clarify valuations and drive deal volumes. Moving forward, investors are going to require a higher return. Producers will have to exercise capital discipline and focus on financial returns rather than volume growth.

Next: strengthen core and refresh strategy

Until a supply-demand balance is found, profitability will be challenged generally, and there may be periods of oversupply (and depressed prices) as producers with idle resources test the market. Moving from survival mode to the “next” phase, companies will need to refresh their strategy and strengthen their core. To do this, they will need to plan and support an operational reboot that focuses on technology and new ways of working. This time, the focus has to be on both cost efficiency and operational efficiency gain to produce more with less. It’s becoming much more likely that getting fit for “$40” may be the new motto.

In previous downturns, the focus has been on capital efficiency, capital preservation and cost reduction. It might be tempting to think that everything that can be done to bring costs down, improve productivity and create financial flexibility has been done. However, there is still significant potential for digitalization to improve efficiency up and down the oil and gas value chain.

Advances in digital hardware and software have made it possible for upstream operators to integrate the planning of various stages in the exploration and production process. Even though significant innovations have already been implemented, there are considerable opportunities to improve coordination by enabling systems to talk to each other, sharing a single version of the vast amounts of data that are collected in a drilling process. Mistakes are reduced, safety is improved, time is saved, and oil becomes cheaper to produce and deliver to consumers.

In the downstream subsector, the untapped potential for digitalization is immense. Other than the spread between crude oil and product prices (which can’t be controlled), the most important factor in refinery profitability is unplanned downtime. A refinery that isn’t running isn’t making money. Remote monitoring, artificial intelligence and predictive maintenance can help get ahead of problems that can shut down a refinery, and they have the potential to be big moneymakers. Refining takes a lot of energy, and digitalization can optimize the use of heat and bring that cost down. The industry was headed this way, but now, with Covid-19 and the demand crunch, remote work and touchless access have twice the advantage.

Outside of digitalization, there are three other strategies that oil and gas companies can pursue to make the best of the present and secure their future. The first is to lock down revenue streams by vertically integrating and becoming their own customer. Big oil got into the refining business to create a market for crude oil, and there are opportunities all along the value chain. The second is cash conservation, which is more urgent than ever. An obvious answer is converting fixed costs into variable costs through shared services or outsourcing. A third strategy is to reduce capital investment without necessarily shrinking the business. A lighter, more agile balance sheet will yield higher returns. Leveraging incumbent know-how and logistical expertise to provide energy to an ever-changing global customer is one pathway to explore. Digitalization and consumer data analytics can be a big help here, enabling companies to monetize other companies’ assets by coordinating their utilization and bringing the right product to market at precisely the right time. Energy as a service, similar to the evolution of software companies’ business model, may finally have arrived as a potential new paradigm for some companies.

Beyond: embrace the energy transition

The “beyond” phase centers around how oil and gas adapts to the new energy world. The driving forces are the disruption of the economy by Covid-19 and the movement toward decarbonization. Both forces push in favor of lower oil and gas demand, and the oil and gas industry will have to respond.

Furthermore, governments across the world may feel the urge to stimulate the economy with infrastructure projects, which could involve renewable energy and electric vehicle charging infrastructure. There’s a precedent for that. The U.S. 2009 stimulus package was leveraged into more than $100 billion in investment in renewable power. If that happens today, the movement toward decarbonization will be accelerated.

Agility and adaptation are the essence of success. Many of the competencies that oil and gas companies cultivate should be applicable to new products in new business models. The energy transition will be the most massive capital reallocation in the history of mankind. It will be difficult to pull it off without using the balance sheet strength of today’s oil companies.

Disruption is never easy to navigate, but it always creates opportunities. The energy transition was coming anyway, and, by the time energy demand recovers from Covid-19, it may be here.

The views reflected in this article are those of the author and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

Get the best of Forbes to your inbox with the latest insights from experts across the globe.

I serve as the EY Americas Industry Leader and Americas Oil and Gas Leader. I am passionate about bringing innovative solutions and strategic counsel to companies to help them grow and deliver long-term value to their various stakeholders, from shareholders and employees, to customers and society. With more than 30 years of experience in the energy industry, I help clients navigate complex transactions and restructurings, develop new business models, review changing tax policy and regulation and plan for the future. I am a frequent speaker on issues facing the oil and gas industry, the energy transition and future energy workforce.

© 2020 Forbes Media LLC. All Rights Reserved.

source:

https://www.forbes.com/sites/deborahbyers/2020/07/20/whats-next-for-oil-and-gas/amp/?__twitter_impression=true